Do I Need Homeowners Insurance? Here’s the Truth.

For those of us with a mortgage, our lenders require us to have homeowners insurance. What if you’ve paid off your house or are renting your home?

Homeowners insurance is expensive. It can be MUCH more expensive not to have it.

You’ve worked so hard to pay off your mortgage! Congratulations! You’ve made a really smart money move! You may think you can get by without insurance now. Hold your horses and let’s stop and think about this for a moment.

Let’s start by asking a few questions. First, are you independently wealthy? Did you manage to both pay off your mortgage AND save at least 120-150% of the cost of your home to set aside for a new home? Are you willing to gamble away all of the money, time, and hard work that went into getting to where you are today in a matter of minutes? Have you ever wanted to be homeless? I’m willing to bet you answered no to at least three of those questions.

Will FEMA Cover Me?

At this point, you’re probably thinking “Yeah, but there’s always FEMA if something happens”. Or, “I’ve lived here X number of years, nothing has ever happened, and we don’t have natural disasters here”. Or, even, “I rent, so I don’t need insurance”. There’s also the procrastinator’s favorite, “I’ll get around to it…later”. Finally, maybe that classic concept is holding you back that having insurance is like making a bet: you’re betting something will happen and the insurance company is betting nothing will happen. No matter which excuse you choose, none of them will help you when the time comes.

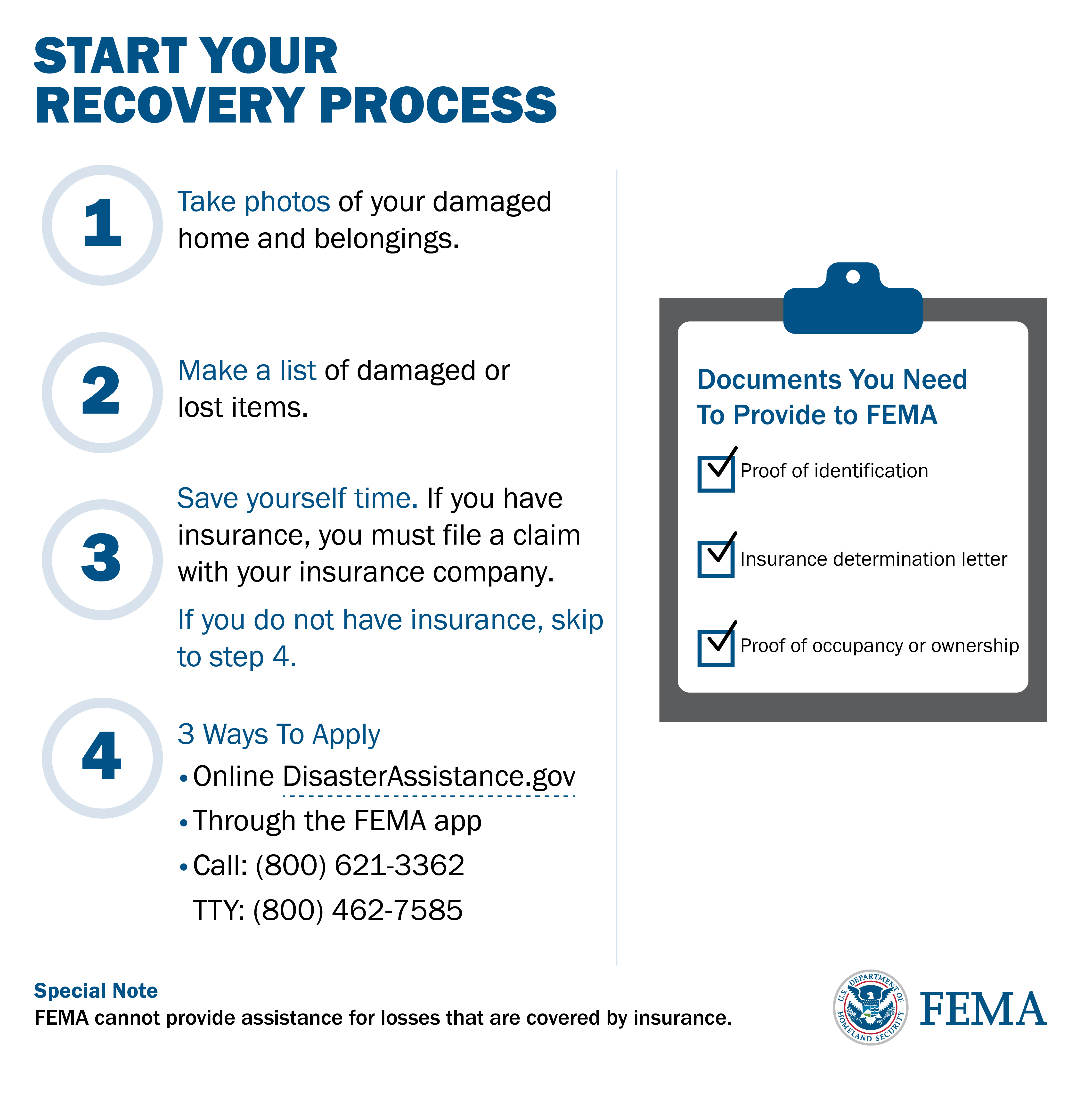

So, let’s move on to some basics. Having to file an insurance claim has its own set of complications, but it’s worth every penny to have it in the long run. There are far too many people that thought FEMA would pay for a new home if they ever needed it. Unfortunately, they had to learn an excruciatingly hard lesson after a natural disaster. FEMA is only a stop-gap measure that will pay for essential repairs to your home and NOT full replacement. You can only receive assistance IF the damage to your home is from an event that is a federally declared disaster. This means that more limited events, such as a sinkhole suddenly swallowing your home, aren’t covered. You’ll still have a couple of options after FEMA though.

SBA Disaster Loans

The next step is an SBA Disaster Loan. This is a low interest loan available for federally declared disaster areas and interest rates for these loans are set by law. The current maximum as of April 2024 is now $500,000 for the primary residence. Secondary or vacation homes are not eligible. Your maximum could be less depending on your damages, house value, other grants or insurance moneys received, and other factors. Though, you may also be eligible for additional loan funds for personal property/ contents and if your repairs will include measures to prevent future disaster related damages (for up to 20% more for mitigation materials). A FEMA fact sheet for a recent disaster showed an interest rate for a residential loan just under 2.9%, but updated information shows it may be up to 4%. You may choose the length of the loan repayment time up to 30 years.

Let’s Run the Numbers

That may all sound pretty reasonable and realistic until you consider the numbers and a few other factors. Running an amortization calculator for a loan of $150,000 (which won’t cover a total loss in most areas) at an interest rate of 4% with a 30 year plan shows the loan will cost you $150,000 in principal PLUS a whopping $107,804 in interest for a total of $257,804 with an estimated monthly payment of $716.00 before associated fees (like property taxes, etc) if you take the full 30 years to pay the loan. The SBA loan also requires that you have insurance on the property for as long as the loan is open. You will have to sign a lien on your property for any loans of $25,000 or more as well.

You may find yourself in a situation where you’re also still paying a mortgage or previous renovation loan in addition to this on the damaged property whether it’s habitable or not. The amount you paid for the home you have lost is likely well below the March 2024 median price of a home at $420,357. This is also nearly the maximum of an SBA Disaster Loan which may not fully cover your loss depending on the cost of housing where you live.

The Cost of Homeowners Insurance

Conversely, the current average homeowner’s policy on a $300,000 house is around $2,000 a year depending on where you live. Some states average well over $4,000 a year, with Oklahoma currently averaging $5,500 a year. Over 30 years at $2,000, that’s $60,000 (plus any deductible if you ever have a claim). It’s certainly not a small number, but it’s $197,804 LESS than the SBA option example. You won’t be financially starting from scratch all over again with insurance, even if your insurance company turns out not to be the good guys after all. It is also important to remember that you should file with FEMA immediately after filing with your insurance in case you need additional assistance you weren’t expecting.

Just because your area hasn’t had a natural disaster since you’ve lived there doesn’t mean you won’t have one. In April 2022 alone, nearly everywhere in the continental US experienced severe weather. These threats included extreme winds, hail, tornadoes, flooding, wildfires, and freezing rain and heavy snows that sent trees falling onto houses. Also, hurricanes are getting more frequent, more extreme, and are reaching areas rarely affected previously on a more regular basis. Rapid intensification of hurricanes is more common as well.

How Soon Do I Need to Get Insurance?

It’s also imperative that you not wait to get homeowners insurance. While your policy generally can begin within a few days, it may be provisional until after an inspection is done (if required) and filed. Also, most companies will not write a new policy for you or make changes to existing policies within 48-72 hours before an approaching hurricane is expected to make landfall. Some coverages can take 30 days or more to go into effect, like flood insurance.

You have to keep in mind, too, that your regular homeowners insurance policy does NOT cover flood damage. You must add it separately. Currently, only 4 in 100 homes are covered by flood insurance. You should check the recently updated flood maps to see if your location has changed and know your zone. NOAA has also recently developed an interactive map showing areas at greater risk for disaster devastation that includes factors such as socio-economic demographics that increase issues with recovery.

Renter’s Insurance

So, what if you’re a renter? Renters insurance is some of the least expensive coverage available with an average range of $15-30 per month. That will cost you $360 per year on the high end. It’s less than the cost of a mid grade futon. It’s substantially less than paying to replace all of your furniture, clothing, and electronics. Your landlord’s insurance policy does not cover you or your belongings. If the home you rent is too damaged to remain in, your renter’s policy can also cover “loss of use” for expenses like hotel rooms.

The U-Haul location in Manhattan had a sign with an image of a truck hanging half-way over a ravine. Like the sign said, “ALWAYS get the insurance!” Insurance may not solve all of your problems if the worst happens and you may have to fight for what you’re owed, but it’s the peace of mind money CAN actually buy! You could also find yourself homeless without it. In the end, if you lose the bet with the insurance company and never need to file a claim, you’ll just have one more thing to add to your gratitude journal!